Commercial

Keeping You Ahead!

Commercial

Keeping You Ahead!

Commercial

Keeping You Ahead!

Commercial

Keeping You Ahead!

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - Sukoon - Tokio Marine - QIC - Noor Takaful - AIG .....

Compare Offers!

Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Open Cover

An open cover is an agreement (not a policy) whereby the insurer will accept insurance of all shipments made by the assured, within the terms of the cover for a fixed period, usually for 12 months. Being an agreement, it is not stamped. However, stamped policies or certificates of insurance are issued against the declaration made by the assured. The open cover is of great convenience to the clients engaged in regular import/export trade.

Open Policy

It is an Annual Cargo Insurance Contract expressed in general terms and effected for a round sum sufficient to cover a number of dispatches until the sum insured is exhausted by declarations. The Open Policy, also known as the Floating Policy, saves the assured the inconvenience of affecting individually the insurance of goods dispatched anywhere in the world. The policy may cover both incoming and outgoing consignments from anywhere in world to anywhere in world except to sanction countries or those countries where insurer have restriction to cover. The sum insured under the policy should ordinarily represent the assured’s estimated annual turnover of the goods.

Specific Voyage

In Marine Insurance specific policies are issued to cover a specific single transit. Cover ends as soon as arrival of cargo at destination.

Goods in Transit (In-land Transit) Policy

Annual policy is granted in respect of goods belonging to the Assured and or held in trust by the assured and not under contract of sale and or purchase which are in transit by road with UAE and can be extended to cover other GCC countries. Important features of this policy are:

In simple words, Marine Insurance covers loss or damage to goods transported through different modes of transport (such as Sea, Air, Land, Rail) from one place to another.

Based on the terms of sale either the purchaser or the seller of the commodity purchases Insurance.

The most commonly used Terms of Sale (Inco Terms):

Brand new , Used , Household goods and personal effects , Reefer cargoes, Project cargoes

For Sea/Air Freight shipments:-

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Professional Indemnity Policy

This policy is meant for professionals to cover liability falling on them as a result of errors and omissions committed by them whilst rendering professional service.

The policy offers a benefit of Retroactive period on continuous renewal of policy whereby claims reported in subsequent renewal but pertaining to earlier period after first inception of the policy, also become payable. Group policies can also be issued covering members of one profession.

In Professional Indemnity Policy, the sum insured is referred to as Limit of Indemnity. This limit is fixed per accident and per policy period which is called Any One Accident (AOA) limit and Any One Year (AOY) limit respectively.

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Business Interruption Insurance

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Contractor’s Plant and Machinery Insurance

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Contractors (Construction) All Risks Insurance

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Electronic Equipment Insurance

This is a specially designed policy which covers accidental loss or damage to electronic equipment. The policy covers the following types of equipment:

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Erection All Risks (also known as Storage Cum Erection Insurance)

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

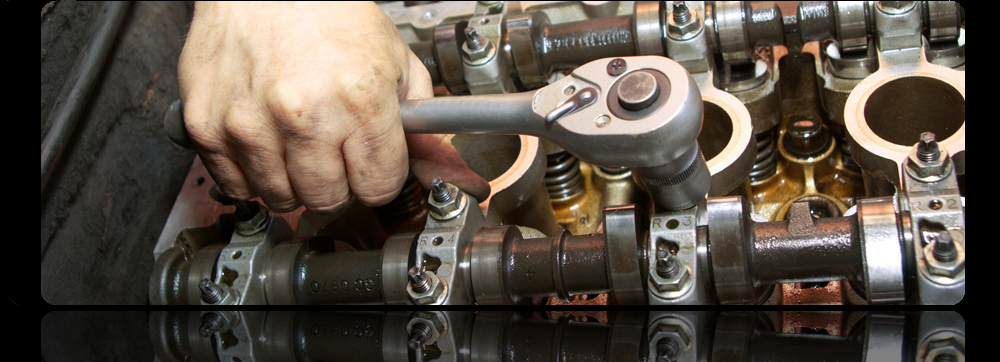

Machinery Breakdown Insurance

This is a policy which covers financial loss incurred by the insured due to loss or damage to machinery as a result of sudden accidental electrical and mechanical breakdown. It reimburses the insured for the cost of repairs or replacement of machinery of like nature.

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Property All Risks Insurance

This insurance policy indemnifies the Insured for accidental physical loss of or damage to the property insured whilst situated at the premises described in the policy. It includes loss or damage by fire, lightning, aircraft, explosion, earthquake, strike, riot, civil commotion, malicious damage, storm, tempest, flood, bursting or overflowing of water apparatus (including sprinkler leakage), impact by own vehicles, theft or attempted theft (by violence to persons or threat thereof or by violent and forcible entry to or exit from the premises) and accidental loss or damage.

The coverage is usually provided for a period of one year. The Sum Insured may be either on the basis of the actual value or the new replacement value of the property but should be adequate to cover the total exposure. The Insured has to provide the sum Insured but may seek the assistance of our technical staff to determine the adequacy. Sum Insured is very important and needs to be given due consideration to avoid application of Average [i.e. application of under-insurance] in the event of a claim.

The rate chargeable is always applied on "Per Mille" basis (for every thousand units) on the total sum Insured and is very much dependent on the nature of risk, location and the housekeeping and other physical features of the risk. There is a deductible for each and every loss under the policy. The insurance is also subject to other terms and conditions as printed on the Policy.

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

This is a package policy specially designed for retail business and office. It is a single policy combining the various insurance requirements. The policy comprises of following sections :

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

Fire & Allied Perils Insurance

Any loss or damage to material and property causes in terms of loss of capital and other consequential losses The aftermath of fire is drastic and monetary relief is essential to rebuild and restore the property and bring back the business to its normal course It is here that fire insurance plays its role in safeguarding the financial interests of entrepreneurs:

Fire insurance Policy covers all immovable and movable property located at a particular premises such as buildings, plant and machinery, furniture, fixtures, fittings and other contents, stocks and stock in process along with goods held in trust or in commission including stocks at suppliers/ customer's premises, machinery temporarily removed from the premises for repairs against loss or damage by fire, and a host of other perils listed below & many more.

Better Price

Better Coverage

Quick E-Quotes

Better Price

Better Coverage

Quick E-Quotes

RSA - AXA - OMAN - Noor Takaful - Tokio Marine - QIC - AIG .....

Compare Offers!

16 Years Market Tips and Intel

Buy Now in Easy Steps

Recent Reviews 1000 +

Testimonials

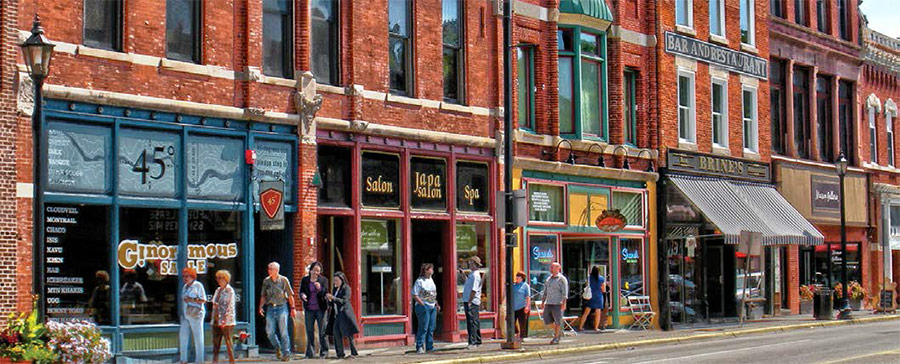

Small and Medium-sized Enterprises (SMEs) are a key component of every economy. The importance of SMEs as employment generators, innovators, factors in the supply chains of larger enterprises, and important contributors to gross domestic product of any Country especially in the UAE.

Most of small & medium enterprises build their businesses through blood and sweat but are often prone to disasters like fire and burglary & legal claims which could wash away their sweat in record time. So, it is essential that products offered should add value and are affordable to targeted consumers.

Keeping that aspects in mind, EIB has the right solution and customize your policy cover to suit & protect your business risks of Assets, Employees & Liabilities in any of the industry categories with the likes of: Retail, Food and Beverages, Offices, Education, Healthcare, Hospitality.

Property / (Fire & Allied Perils): Loss or damage to stocks, furniture, fixtures, fittings and other contents. Also, Loss or damage resulting from theft, including burglary and robbery, or any attempt of the same.

Glass and Signs: Accidental breakage of glass, as well as the costs of repairing damaged signs or other outdoor fixtures or fittings of the insured property.

Business Interruption: Consequent upon the Damages to Property and the business being interrupted, this covers the resulting financial losses (loss of profits) in the normal business operations.

General Third-Party Public Liability: Any legal liability to pay compensation to third parties for personal injury or property damage.

Workmen Compensation/Employers Liability – Compensation for Work related Injuries and Sickness as per UAE Labour Law 8 of 1980

Money: Loss of money and unpresented cheques while locked in a safe, strong room or drawer on business premises.

Fidelity Guarantee: Loss of money or stocks as a direct result of acts of fraud, theft or dishonesty by an employee in the course of employment

Electronic Equipment: Accidental Loss of or damage to the Electronic equipments as a direct result of Operations, electrical faults, human element and other specified risksPersonal Accident: Loss arising from accidental injury, permanent disablement or death of your employees, including when they are travelling overseas.

Companies with an annual turnover of less than AED 40 million &/or others have specific insurance requirements from the local authorities/Financial Institutions including of Free Zones.